Today’s Psychedelic Stock Spotlight: Field Trip Health Ltd. (FTRPF)

Risk Profile: High Risk/Moderate-High Reward

(Disclaimer: These articles are merely informational in nature, and in no way should be considered expert financial advice. As with any investment, psilocybin stocks, especially those owned by newer companies, are subject to significant fluctuations in value. Therefore, caution should always be observed when investing.)

Located in Toronto, Field Trip Health Inc. is an innovative company that focuses on integrating ketamine and psychotherapy in a structured, supportive setting, emphasizing the co-participation of the patient. Their website states the essence of their work as the following: “We work from a trauma-informed care lens, and work with you every step to tailor your experience to your unique needs. Safety is required for healing, and your active consent is a vital building block to your process.”

Field Trip Health Data

At a current price of $5.52/share, FTRPF has shown mostly steady growth since its inception in October 2020 at $2.10/share, a 162% increase, down from the high in mid February of $6.49. Currently, the market cap (intraday) is $230.66M, and the enterprise value is $227.88M. A 200-day moving average of $4.58 also communicates a fairly steady outlook for the stock. However, profitability may be an issue for Field Trip Health as the EBITDA (earnings before interest, taxes, depreciation, and amortization) is -$13.28M, while their Net Income Avi to Common is -$16.06M, indicating potential issues with profitability. Currently, P/E data is not available.

Volatility, especially daily volatility, is also an issue. The website stockinvest.us states “This stock may move very much during the day (volatility) and with a very large prediction interval from the Bollinger Band this stock is considered to be “very high risk”.

Is FTRPF a good stock to buy? Maybe, for those with a watchful eye. According to Marketbeat.com, “2 Wall Street analysts have issued ratings and price targets for Field Trip Health in the last 12 months. Their average twelve-month price target is $10.00, predicting that the stock has a possible upside of 81.32%. The high price target for FTRPF is $10.00 and the low price target for FTRPF is $10.00. There are currently 1 sell rating and 1 buy rating for the stock, resulting in a consensus rating of ‘Hold.’”

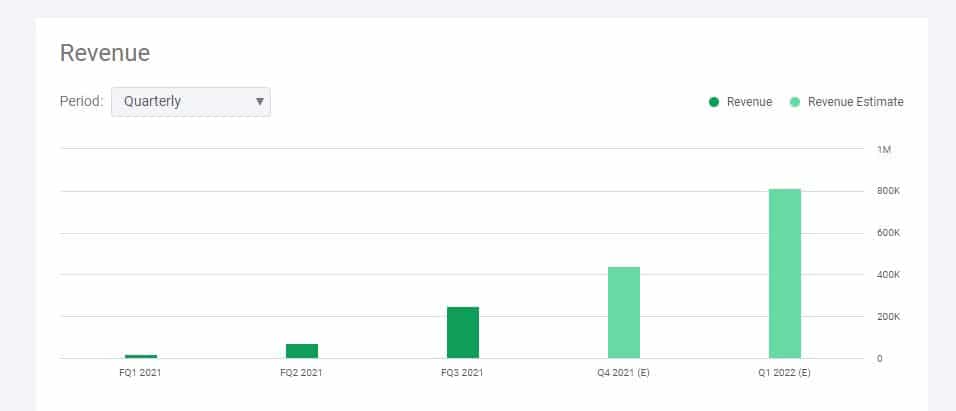

Moreover, the website seekingaplha.com has a rosy prediction for revue growth, with a robust project of $800,000 for their first quarter of 2022:

Source: https://seekingalpha.com/

Like other psychedelic stocks, FTRPF needs to be closely monitored by investors.

At Newsweed.com, we adhere to three simple principles: truth, balance, and relatability. Our articles, podcasts, and videos strive to present content in an accurate, fair, yet compelling and timely manner. We avoid pushing personal or ideological agendas because our only agenda is creating quality content for our audience, whom we are here to serve. That is why our motto is ”Rolling with the times, straining for the truth.”

Your opinion matters. Please share your thoughts in our survey so that Newsweed can better serve you.

Charles Bukowski, the Los Angeles beat poet that captured the depravity of American urban life once said, “There is something about writing poetry that brings a man close to the cliff’s edge.” Newsweed is proud to stand in solidarity and offer you a chance to get close to the cliff’s edge with our first Power of Poetry Contest. Are you a budding bard, a versatile versifier, a rhyming regaler? Do you march to the beat of iambic pentameter, or flow like a river with free verse? If so, here’s your opportunity to put your mad poetic chops to the test. Enter our poetry contest for bragging rights and an opportunity to win some cash