Ernest Hemingway once acerbically remarked, “The first panacea for a mismanaged nation is inflation of the currency; the second is war. Both bring a temporary prosperity; both bring a permanent ruin. But both are the refuge of political and economic opportunists.”

Are Hemingway’s words valid in 2021? Are Americans on the precipice of economic disaster, or are concerns about the damage inflation will do being greatly exaggerated? Given there is no crystal ball, only time will ultimately answer such questions.

Inflation Fears

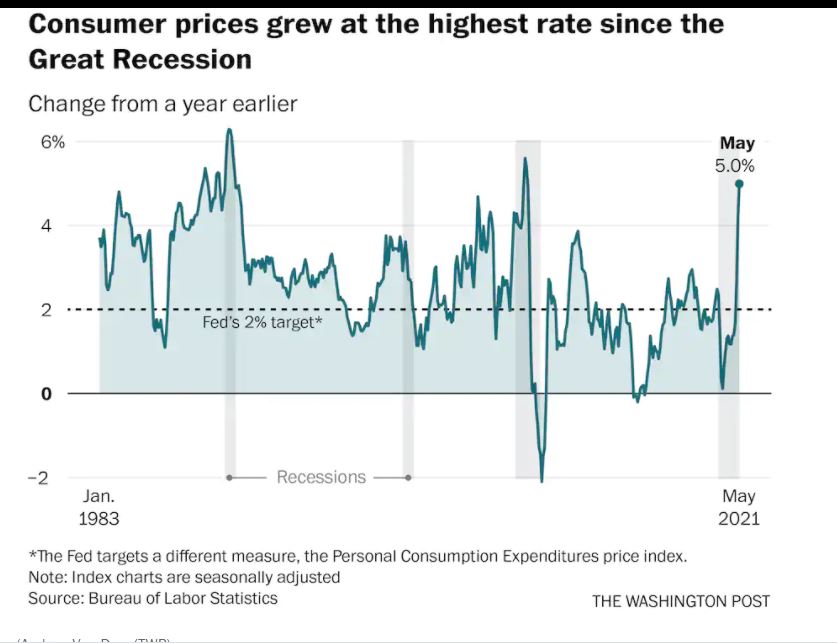

Americans have genuine reasons to fear inflation. According to a recent Washington Post article, “The latest government data showed prices rose 5 percent from a year earlier, triggering fears that the economy is overheating.” Of course, the consensus is that most of this increase is a result of post-pandemic resurgence, as Americans re-engage the economy in a robust manner.

As the Post article points out, “Most of the May inflation spike comes from parts of the economy that are reopening (such as travel) or in areas that saw unusually high demand during the pandemic, which may not persist much longer (like bicycles).”

A Kiplinger forecast echoes the Post’ sentiments: “Expect much higher inflation this year, with overall prices rising 5.0% over the course of the year, as a reopening economy, government stimulus, and shortages combine to push prices up in many areas.”

Yet, it’s not that simple. As the website, inflationdata,com, an entity dedicated to providing information about the nature of inflation, posits “. . . even moderate inflation can rapidly erode purchasing power and creates uncertainty as businesses have more difficulty estimating future costs. Usually, high inflation rates also correspond to high interest rates as lenders need to compensate for the decline in purchasing power of future interest and principal repayments. This results in higher costs of doing business and place(s) an overall drag on the economy.”

A Simple Example of Inflation

Here is a simple, though far-from-perfect example of the pernicious nature of inflation using simple interest. Suppose the inflation rate is 5% (much like an interest rate) and you earn $50,000 a year (much like a loan amount).Over a period of 10 years, it would cost approximately $530/month, which would translate into paying $13,600 in interest during that 10-year time period, or $113/month. That’s $113 less for food, gas, utilities, essential goods and services people cannot live without.

Nor is this limited to only essential items and services. A Yahoo finance article makes the following prediction: “Americans are likely to see prices jump across a variety of sectors next year, thanks in part to Covid-19 vaccines that will potentially turbocharge demand for such pandemic casualties as travel and tickets to sporting events.”

Inflation: Consumers are the True Losers

Ultimately, inflation damages our purchasing power over the long term because it’s economic pressures are cumulative. This is because this slow but persistent erosion of our ability to purchase goods and services is caused by a deflation of the value of the dollar. A publication by the Kahler Financial Group frames it this deleterious dynamic with the following example:

With inflation, the losers are the people and institutions that own the debt, because the currency shrinks in value. For example, say you loan the government money by buying a $1000 U.S. government bond that matures in ten years. At the time you buy it, you could buy a fully loaded laptop or a round trip ticket to London for $1000.

Now, let’s say the U.S. inflates its currency at a 7% rate for the next ten years, which would be about twice the “normal” inflation rate of 3.3% for the past 80 years. At the end of that time the bond matures and you get your $1000 back. You go to buy a laptop; they now sell for $2000. That trip to London costs $2000, too. Many people in this situation will think that the prices of laptops and airline tickets have gone up.

Actually, in real dollars (which are dollars adjusted for inflation), the cost of these items hasn’t gone up a dime. It’s the value of the dollar that’s gone down, in this case, by 50% over ten years. The big winner here is the U.S. government, because its multi trillion-dollar debt has been chopped in half (again in real dollar terms) in ten short years. They accomplished this without raising taxes or cutting spending, which is intoxicatingly appealing to politicians.

Lifestyle Inflation

Moreover, because GDP is expected to be robust, with more people entering the workforce as businesses gear up, consumer spending is likely to increase, creating what is known as “lifestyle inflation,” which is simply spending more because we have more disposable income.

This style of spending, while enjoyable, has negative consequences on our retirement picture, however. As Kristin McKenna writes in the article The True Cost Of Lifestyle Inflation, “An investor 50 years old would need to save an additional $745 per month for 15 years to spend an additional $10,000 per year in retirement, assuming a 6% rate of return in a taxable account.”

The result is that this inflationary pressure is likely to outstrip rises in wages that happen when an economy rebounds. This is because spending, wages, and inflation are linked to consumer expectations.

As a Brookings Institution blog puts it: “Inflation expectations are simply the rate at which people—consumers, businesses, investors—expect prices to rise in the future. They matter because actual inflation depends, in part, on what we expect it to be. If everyone expects prices to rise, say, 3 percent over the next year, businesses will want to raise prices by (at least) 3 percent, and workers and their unions will want similar-sized raises. All else equal, if inflation expectations rise by one percentage point, actual inflation will tend to rise by one percentage point as well.”

But according to Brookings, there is a catch. If inflation persists, we could risk getting caught in a vicious cycle in which “high inflation drives up inflation expectations, causing workers to demand wage increases to make up for the expected loss of purchasing power.” And, according to Brookings, “When workers win wage increases, businesses raise their prices to accommodate the increase in wage costs, driving up inflation. The wage-price spiral means that when inflation expectations rise it is difficult to bring down inflation, even if unemployment is high.”

Inflation and Wages

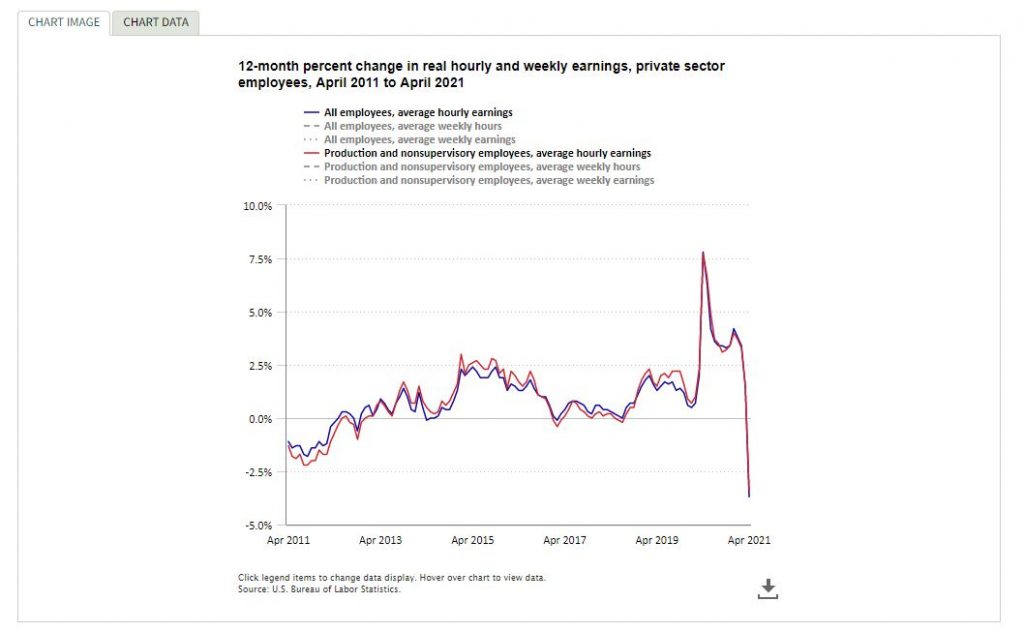

Complicating matters is the condition of the job market with regard to wages. Although our economy shows signs of shaking off the pandemic-induced doldrums, recent data is a stark reminder of the holes in our recovery.

A May report by the U.S. Bureau of Labor Statistics had the following grim warning: “Real average hourly earnings decreased 3.7 percent from April 2020 to April 2021. The change in real average hourly earnings combined with an increase of 2.3 percent in the average workweek resulted in a 1.4-percent decrease in real average weekly earnings over this period.”

And although it’s too early to make any valid predictions about wages, we should keep our collective jaundiced eyes on the big picture.The editorial board of the Issues and Insights organization put it this way: “As inflation rises, real wages — that is, earnings adjusted for inflation — inevitably go down. Just as in the 1970s, low-skilled, less-trained and less-schooled workers can’t keep up. Their wages fall behind. That’s the real danger here.”

The Unpredictability of Inflation

Part of the problem, of course, is the unpredictability of not only inflation, but the economy as a whole. As the Danish quantum theory physicist Neils Borh once famously quipped, “Prediction is very difficult, especially if it’s about the future.” There are simply numerous variables all interacting in complex ways that are difficult to quantify or capture. In fact, there is much debate among economists about the future.

A June 11 report by the Council of Foreign Relations lays it out in no uncertain terms: “The bottom line is that there is little consensus about the path of inflation in the United States for the next several years. With such a wide range of potential outcomes, each supported by reasoned analysis, the entire economics profession—including policymakers at the Federal Reserve itself—should be on high alert.”

Tellingly, the Federal Reserve itself seems to agree, stating: “The economic and statistical models and relationships used to help produce economic forecasts are necessarily imperfect descriptions of the real world, and the future path of the economy can be affected by myriad of unforeseen developments and events.” Wow, now that’s reassuring.

Even less reassuring is the Reserve’s policy regarding the buying of bonds, a core component of the tools used to manipulate inflation. In an Op-Ed for the American Enterprise Institute, Desmond Lachman warns us about the hidden consequences of this approach:” In particular, the Fed seems to be unfazed by the fact that over the past year the Fed’s highly aggressive bond-buying program has contributed to a 30 percent increase in the broad money supply. That is the fastest pace of U.S. money supply increase in the past sixty years by a multiple of around 3.”

There are signs the feds are nervous about inflation. A report by CNBC stated that “. . .officials indicated that rate hikes could come as soon as 2023, after saying in March that it saw no increases until at least 2024.” Still, the long-term approach of inflating the money supply will likely continue. In a post-meeting news conference, Federal Reserve chairman Jerome Powel stated “[O]ur expectation is these high inflation readings now will abate,” which probably signals the bond-buying program will continue in some manner.

All of this extra money sloshing around in the economy is bound to eventually cause problems for the average consumer, even if the macro statistics indicate otherwise. As Roger W. Fergusen Jr., a Steven A. Tananbaum Distinguished Fellow for International Economics at the Council for Foreign Relations puts it, “In short, official statistics are understating the inflation that consumers are experiencing. As these price increases are felt, they will push consumers to expect even higher inflation and thus demand higher wages, kicking off a vicious inflation spiral.”

This difference between how federal officials capture and measure inflation, and how U.S. citizens experience it might be called “inflation perception schism.” While officials talk in terms of Gross National Product (GNP), Consumer Price Index (CPI), and Secondary Market Corporate Credit Facility (SMCCF), everyday people talk about the cost of gas, food, and rent. They talk about buying clothes for their kids, about saving for college, and about having enough money to afford the skyrocketing cost of healthcare.

J.W. Mason, an economist at John Jay College and fellow at the Roosevelt Institute captures this schism perfectly, saying “We don’t see rising inflation across the board because rising prices in some areas are being offset by falling prices in other areas.”

Moreover, Mason has little confidence in the prognostication powers of federal officials, pointing out “We don’t know what drives inflation in the contemporary United States, and we’re not sure we’re modeling it the right way. We can’t make policy choices right now based on any kind of confident beliefs about what inflation is going to be in the future.” All of this uncertainty makes life stressful for the average U.S. citizen, who is trying to keep his or her proverbial head above water while saving for retirement simultaneously.

And, if you peel the economic onion back a little more, it starts to sting your eyes. Some people believe that inflation is nothing more than a massive scheme by the federal government to pay back our national debt on the cheap. In the blog post, What is the Current Inflation Rate? by Tim McMahon, the author sounds the warning bell:

By devaluing the dollar, the government is able to pay back the debt with cheap money. Since high inflation is detrimental to the overall economy but beneficial to the government (since it allows them to pay back their debt with “cheaper dollars”) the Federal Reserve has a constant balancing act to try to reconcile the government’s desires for higher inflation with the need for a healthy economy. Their major argument revolves around the “stimulating” effects of inflation.

Basically it makes people feel richer until they eventually realize that each of their dollars now buys less. But in the meantime they tend to spend the “excess”. This results in people buying things they wouldn’t have, had they realized that their money was actually worth less than they thought. Eventually this results in a monetary “hangover” as the effects of their buying binge become apparent.

In some respects, the average U.S. consumer is like a small child watching their parents make potentially reckless decisions, unable to do anything meaningful about it. Meanwhile, one has to wonder if the celebrated economist, John Maynard Keynes, a darling of the progressives, was on to something when he said: “By a continuing process of inflation, government can confiscate, secretly and unobserved, an important part of the wealth of their citizens.” Only time will tell. Are Americans on the precipice of economic disaster, or are concerns about the damage inflation will do being greatly exaggerated? Only time will tell, but meanwhile, maybe we should all read some more Hemingway.

Charles Bukowski, the Los Angeles beat poet that captured the depravity of American urban life once said, “There is something about writing poetry that brings a man close to the cliff’s edge.” Newsweed is proud to stand in solidarity and offer you a chance to get close to the cliff’s edge with our first Power of Poetry Contest. Are you a budding bard, a versatile versifier, a rhyming regaler? Do you march to the beat of iambic pentameter, or flow like a river with free verse? If so, here’s your opportunity to put your mad poetic chops to the test. Enter our poetry contest for bragging rights and an opportunity to win some cash!

Your opinion matters. Please share your thoughts in our survey so that Newsweed can better serve you.