Arthur Vanderbilt, former Chief Justice of the New Jersey Supreme Court from 1948 to 1957, had these pithy words about taxation: “Taxes are the lifeblood of government and no taxpayer should be permitted to escape the payment of his just share of the burden of contributing thereto.” With ProPublica’s bombshell report, The Secret IRS Files: Trove of Never-Before-Seen Records Reveal How the Wealthiest Avoid Income Tax, it appears that the authors wholeheartedly agree, and want the blood supply reestablished.

Beyond claims about 25 specific individuals skirting their patriotic duty to fill the federal coffers, including business and investment magnates such as Warren Buffet, Elon Musk, Micheal Bloomberg, Carl Icahn, Bill Gates, Rupert Murdoch, and Mark Zuckerberg, the authors, Jesse Eisinger, Jeff Ernsthausen and Paul Kiel contend the following about their analysis: “Taken together, it demolishes the cornerstone myth of the American tax system: that everyone pays their fair share and the richest Americans pay the most.”

On the surface, the conclusions of their analysis are indeed disturbing, stating: “The results are stark. According to Forbes, those 25 people saw their worth rise a collective $401 billion from 2014 to 2018. They paid a total of $13.6 billion in federal income taxes in those five years, the IRS data shows. That’s a staggering sum, but it amounts to a true tax rate of only 3.4%.”

The report then levies this accusation, which is dripping with loaded language:

“America’s billionaires avail themselves of tax-avoidance strategies beyond the reach of ordinary people. Their wealth derives from the skyrocketing value of their assets, like stock and property. Those gains are not defined by U.S. laws as taxable income unless and until the billionaires sell.”

However, it may not be as nefarious of a situation as it seems.

But, before I challenge their analysis and conclusions, let me be clear about my perspective. I actually partially agree with the issues the authors identified. Eisinger, Ernsthausen, and Kiel are right to point out that “Many Americans live paycheck to paycheck, amassing little wealth and paying the federal government a percentage of their income that rises if they earn more,” and that “the ultrarich [at least those identified in the study] effectively sidestep this system.” And they stop short of accusing these individuals of breaking any laws, instead emphasizing the absurdity “that the wealthiest can — perfectly legally — pay income taxes that are only a tiny fraction of the hundreds of millions, if not billions, their fortunes grow each year.”

Still, in the interest of cerebral high-mindedness the authors advocate for, perhaps a wider context is appropriate. I will attempt to delineate this context by exploring the following points:

- ProPublica refuses to divulge the source of their information.

- Both ProPublica and the donors that support them may be benefitting from the same system as the accused.

- ProPublica’s use of loaded/fuzzy language obscures understanding of the issues.

- The overall burden of our taxation is still paid by the wealthiest citizens of the United States.

PROPUBLICA REFUSES TO DIVULGE THE SOURCE OF THEIR INFORMATION

The report plainly states, “ProPublica is not disclosing how it obtained the data, which was given to us in raw form, with no conditions or conclusions,” offering this line of reasoning: “One of the billionaires mentioned in this article objected, arguing that publishing personal tax information is a violation of privacy. We have concluded that the public interest in knowing this information at this pivotal moment outweighs that legitimate concern.” Well, that seems a bit self-righteous at the very least. When did ProPublica appoint itself as the bastion of knowing when an illegal act is morally justified, as if they are somehow imbued with an unshakable and unquestionable sense of ethics and deeper understanding of the law than, say, everyone else?

Of course, ProPublica got out ahead of the legal angle. In a piece titled, Why We Are Publishing the Tax Secrets of the .001%, the ProPublica engages in a form of intellectual jujitsu with its attempt to rationalize their act:

“There is also a legal question here, and we want you to know we have taken it seriously. A federal law ostensibly makes it a criminal offense to disclose tax return information. But we do not believe that law would be constitutional if applied to bar or sanction publication of a story in the public interest when the news organization did not itself remove the information from the control of the IRS or solicit anyone else to do so — as we did not.”

Let me translate. If we, the guardians of those we deem oppressed by the fiscal skullduggery, judge a law to be invalid because we possess scrupulous superiority, then so be it. Regardless of the inherent hypocrisy, this attitude not only smacks of a form of insidious inside baseball, it sets a dangerous moral precedence. As Jeremy Arnold observes in his article, ProPublica’s Bombshell, Bullshit Tax Story What happens when journalists don’t have any friends in finance to challenge their thinking?:

“When, as an industry, you wave a flag saying ‘hey if any of y’all find good dirt that will help us sell newspapers, hit us up and we’ll probably print it’, you’re collectively inducing just that sort of theft. People will leak things to you for all sorts of motivations, many of them bad, and if your only criteria for publishing are some measure of verification and some measure of newsworthiness, that’s a moral hazard.”

Either rule of law and respect for privacy matters, or it doesn’t. Either way, ProPublica seems to revel in their role as guardians of fairness, irrespective of the future consequences.

BOTH PROPUBLICA AND THE DONORS THAT SUPPORT THEM MAY BE BENEFITTING FROM THE SAME SYSTEM AS THE ACCUSED

The basic thrust of ProPublica’s article is that the wealthiest Americans don’t pay their fair share of income tax because they make money from investments, which when they borrow against, are not considered a form of income, so are not fully taxed. As ProPublica puts it:

“The tax math provides a clear incentive for this. If you own a company and take a huge salary, you’ll pay 37% in income tax on the bulk of it. Sell stock and you’ll pay 20% in capital gains tax — and lose some control over your company. But take out a loan, and these days you’ll pay a single-digit interest rate and no tax; since loans must be paid back, the IRS doesn’t consider them income. Banks typically require collateral, but the wealthy have plenty of that.”

The authors are not inaccurate in this charge. Borrowing money does allow companies to minimize tax liability, and perhaps it’s time to revisit this in the interest of fairness.. The problem is the benefactors that make ProPublica able “To expose abuses of power and betrayals of the public trust by government, business, and other institutions” may be benefitting from similar arrangements in the tax code.

According to their website, ProPublica is a 501(c)(3) nonprofit organization and “are exempt from paying most federal income tax, and donations to them are exempt from tax.” Founded in 2007 by businessman Herbert Sandler and his partner and late wife, Marion Osher Sandler, ProPublica is supported by hefty philanthropic contributions from a variety of entities.

As reported by The Bridgespan Group, a nonprofit organization whose services “include strategy consulting and advising, sourcing and diligence, and leadership team support” for philanthropic and nonprofit organizations, “the Sandlers reached out to others for additional funding and support. At launch, ProPublica was also backed by Atlantic Philanthropies, the JEHT Foundation, and the John D. and Catherine T. MacArthur Foundation.”

Even more telling is the following statement from the report: “Many of the richest create foundations for philanthropic giving, which provide large charitable tax deductions during their lifetimes and bypass the estate tax when they die.” You mean the same tax advantage that ProPublica and its donors use?

Additionally, according to the nonprofit group Influence Watch, ProPublica’s “2018 revenue of $26,685,933 was several million dollars less than its annual report-noted $30 million in revenues.” So in the end, neither ProPublica nor its philanthropic partners seem as though they would like to pay more in taxes, nor am I arguing they should.

Ultimately, these donations function as tax write-offs for donors, thus reducing taxable income. Now, I want to be clear about this. I am not condemning giving to charity, nor do I advocate eliminating these deductions. I am also not equating Propublica’s allegations against the super-wealthy to using charitable tax deductions to your advantage.

My point is that all of them are benefiting from legal structures in our current tax code that reduce the amount of taxes paid. How the hypocrisy can be lost upon ProPublica is a mystery to me, perhaps qualifying for the 9th wonder of the world.

Interestingly, a target of ProPublica’s report is the billionaire George Soros. Why do I say interestingly? Because Soros is a contributor to ProPublica, which received a two-year contribution of $125,000 each year from the Open Society Foundations, a private grantmaking foundation created and funded by the billionaire financier and liberal philanthropist, as reported by AllSides. The bottom line is a little more intellectual honesty and consistency would be nice.

PROPUBLICA’S USE OF LOADED/FUZZY LANGUAGE OBSCURES UNDERSTANDING OF THE ISSUES

To begin with, in its zealous analysis, ProPublica used a rhetorical sleight of hand in their interpretation of current tax law, stating “To capture the financial reality of the richest Americans, ProPublica undertook an analysis that has never been done before. We compared how much in taxes the 25 richest Americans paid each year to how much Forbes estimated their wealth grew in that same time period.”

The issue with this approach is that our tax code intentionally avoids this type of fiscal quicksand. Andrew Moyland and Andrew Wilford, writing for Reason Magazine, characterize this verbal manipulation this way:

“It’s hard to overstate how nonsensical this comparison is (which is perhaps why it’s never been done before). Our tax system rightly does not tax growth in one’s wealth until it is realized as income. After all, the alternative is a monstrously complex and unfair system of wealth taxation that developed countries have avoided. The reason that wealth isn’t taxable is fairly straightforward: You aren’t directly benefiting from it until it’s turned into income (at which point it is taxable). Wealthy Americans may not pay taxes on the growth that their net worth sees, but should they wish to sell assets that have appreciated in value, they would be liable for capital gains taxes on that growth.”

And Jeremy Arnold agrees, pointing out that “Instead of asking why the tax code treats unrealized gains (on things you haven’t sold) differently from realized gains (on things you have sold), they just invented a new measure to make it seem like folks with lots of unrealized gains are avoiding taxation.”

Secondly, ProPublica’s report states “America’s billionaires avail themselves of tax-avoidance strategies beyond the reach of ordinary people. Their wealth derives from the skyrocketing value of their assets, like stock and property. Those gains are not defined by U.S. laws as taxable income unless and until the billionaires sell.”

But avoiding taxation, i.e., “tax evasion” is something entirely different. As defined by the Legal Information Institute of Cornell University, “Tax evasion is using illegal means to avoid paying taxes. Typically, tax evasion schemes involve an individual or corporation misrepresenting their income to the Internal Revenue Service. Misrepresentation may take the form either of underreporting income, inflating deductions, or hiding money and its interest altogether in offshore accounts.”

Moylan and Wilford allude to the same thing:

“That doesn’t constitute tax evasion; it’s just how the code works. It’s worth noting how intentionally deceptive this is. ProPublica easily could have scored plenty of Twitter clicks by taking this data and using it to show the impact of a wealth tax on rich Americans, for example. Instead, they chose to deliberately mislead readers in order to advance a narrative of corruption and shadowy backroom carve-outs for wealthy boogeymen.”

By reinventing how tax law should work versus how it actually does, and playing fast and loose with language in a way that promotes the idea of dishonest dealings, ProPublica is engaging in a bit of pecuniary solipsism, an “eat the rich” ideology cleverly disguised as moral outrage.

THE OVERALL BURDEN OF OUR TAXATION IS STILL PAID BY THE WEALTHIEST CITIZENS OF THE UNITED STATES

Although ProPublica’s report focused on only 25 individuals, the implication is hard to miss: the people in the hard-working middle class and the ones struggling with the hardships of poverty are ultimately the victims of an elite financial cartel who wield their power in ways that are inherently unfair. Here is an example of the hyperbolic vitriol:

“Experts have long understood the broad outlines of how little the wealthy are taxed in the United States, and many laypeople have long suspected the same thing.”

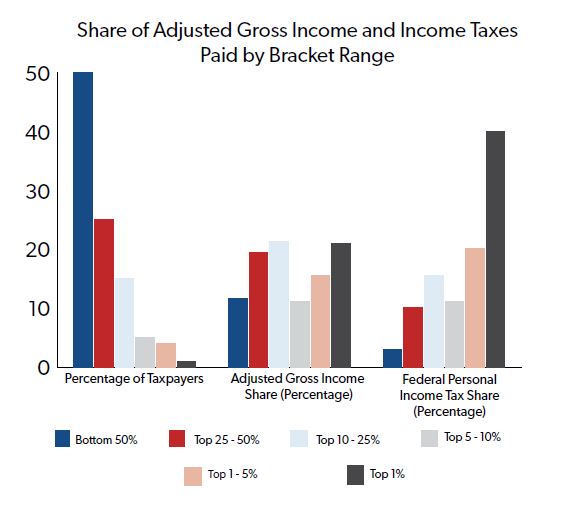

Yet, this is patently untrue. Take a look at the following chart from The National Taxpayers Union Foundation, which is based on IRS data:

As you can see, the top 1% (which includes the .001% ProPublica focuses on) pays more than 40% of the national tax bill, and the top 5% another +20% of the burden. Together, this group shoulders more than 60% of all federal taxes paid. Clearly the progressive aspect of our tax code is healthy and robust.

And ProPublica is not squeamish about where to lay at least part of the blame for this fiduciary chicanery, impugning our tax code as a whole as being manipulated to serve the interest of its evil overlords, the ‘ultrawealthy,’ stating “. . . through a combination of political donations, lobbying, charitable giving and even direct bids for political office, the ultrawealthy have helped shape the debate about taxation in their favor.”

ProPublica was particularly clear about the role that former President Trump played in this matter:

“When it came to his taxes, Bloomberg managed to slash his bill by using deductions made possible by tax cuts passed during the Trump administration, charitable donations of $968.3 million, and credits for having paid foreign taxes. The end result was that he paid $70.7 million in income tax on that almost $2 billion in income. That amounts to just a 3.7% conventional income tax rate.”

Setting aside the point I made earlier that ProPublica is a direct beneficiary of the charitable donations it so decries, the reality is that Trump’s tax cuts, even if supposedly intended to decrease the IRS’s shares of wealthy wampum, haven’t actually worked out that way. Again, data from The National Taxpayers Union Foundation contradicts this notion regarding the share of taxes that the wealthy pay:

“Despite the tax rate reductions associated with TCJA ([Tax Cuts and Jobs Act], this figure is up slightly from the previous tax year’s 38.5 percent share. In fact, NTUF has compiled historical IRS data tracking the distribution of the federal income tax burden back to 1980 and this is the highest share recorded over that period, topping 2007’s 39.8 percent income tax share for the top 1 percent.”

So, there you have it. Maybe it is true that the 25 individuals identified in the ProPublica report should pay more, but the idea that our tax system is perverse and punishes the middle class at the expense of the rich might be an overstatement.

At the end of the day, we should be less concerned with the tax logistics of the ultra-wealthy and focus on how to help people of modest means create and retain wealth. We are still a rags-to-riches country for those willing to put in the sustained effort and discipline it requires. (The much-maligned Warren Buffet started his entrepreneurial path as a child by selling chewing gum, Coca-Cola bottles and magazines door to door.)

And yes, I also acknowledge this means investing in the historically disadvantaged communities through education and outreach programs.

But I also believe in what Abraham Lincoln said: “Let not him who is houseless pull down the house of another, but let him work diligently and build one for himself, thus by example assuring that his own shall be safe from violence when built.” The only thing I would add is that we should help others build their houses when they show the initiative to do so.

Your opinion matters. Please share your thoughts in our survey so that Newsweed can better serve you.

Are you a budding poet? Enter our poetry contest for bragging rights and an opportunity to win some cash!