Today’s Psilocybin Stock Spotlight: MindMedicine (MindMed) (NASDAQ:MNMD)

Risk Profile: Moderate-High Risk/Moderate-High Reward

(Disclaimer: These articles are merely informational in nature, and in no way should be considered expert financial advice. As with any investment, psilocybin stocks, especially those owned by newer companies, are subject to significant fluctuations in value. Therefore, caution should always be observed when investing.)

Addiction and mental illness are plagues consuming the lifeblood of America. And when people suffer from both of these diseases, the odds are overwhelmingly stacked against them. According to the National Institute on Drug Abuse, “Multiple national population surveys have found that about half of those who experience a mental illness during their lives will also experience a substance use disorder and vice versa.” But there may be a breakthrough on both fronts, thanks to research discoveries about the application of psychedelic therapeutics.

MindMed: A Synthesis of Medicine and Technology

The company MindMed seems to be focused on both the mental health and the addiction fronts, and may additionally offer an opportunity to make money for their stockholders. With an emphasis on treatments for anxiety, addiction, and adult ADHD, MindMed (MNMD) focuses on the use of psilocybin, LSD and MDMA in conjunction with cutting-edge virtual technology protocols to help patients process underlying conflicts and trauma.

MindMed is currently engaged in phase 2 drug trials, and according to Whitefoot, “On February 11, MindMedicine announced a new partnership with Swiss startup MindShift Compounds AG to develop and patent next-generation compounds with psychedelic or empathogenic properties.”

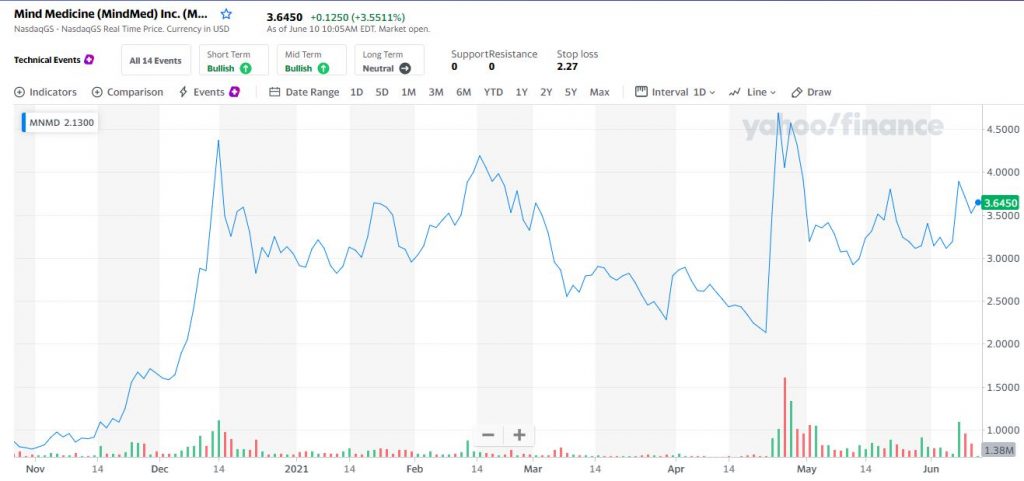

MindMed: An Affordable Entry

And with a current share price of $3.52, the Canadian company offers an affordable entry into the psychedelic therapeutics market. Although the stock has plunged from its initial high of $9.04/share in early 2017, MNMD has performed well over the past 12 months, achieving a 993.20% growth during this time period.

MNMD’s performance has not escaped the attention of heavy hitter investors. Bruce Linton, cannabis pioneer and founder/ex-CEO of Canopy Growth (NYSE:CGC), and Kevin O’Leary, (AKA Shark Tank‘s “Mr. Wonderful) were initial MindMedicine investors. Currently, Linton is a board director and O’Leary is a silent partner, according to John Whitefoot of profitconfidential.com.

Speaking with Matthew Frankel of Motley FooI, O’Leary stated, “I became a very early investor in MindMed, I became an advocate for the whole sector. I’m a spokesperson for it, I’m a big believer in these medicines, and lo and behold, JR’s company [JR Rahn is the cofounder and co-CEO of MindMed] is now a $2 billion market cap. I’m one of the early seed investors. It’s the best investment I’ve made in decades. I think it’s just the beginning of the game.”

MindMed Financials

MindMed looks as though it’s getting its financial house in order. In October of 2020, MindMed issued the following statement: ”Pursuant to the underwriting agreement with Canaccord Genuity Corp. (the “Underwriter“), the Underwriter has agreed to purchase, as sole bookrunner and underwriter, 23,810,000 units of the Company (the ‘Units’), on a ‘bought deal’ basis, at a price per Unit of $1.05 CAD (the ‘Issue Price’) for gross proceeds of $25,000,500.”

With $220.79 million in Total Assets, only $13.20 million in Total Liabilities, and a “fair value” rating by Morning Star, the first quarter looks pretty rosy for MindMed. And, with a current P/E ratio of 25.53, MindMed is poised to be a potentially solid investment.

However, there are always caveats, as captured by The Psychedelic Investor: “MindMed’s trials continue yield positive results, they get approval to sell these drugs, they are successful in producing huge volumes of their medicine, and they disrupt several mental health drug industries, early investors will be very happy. Having said that, there is still much that can go awry. MindMed is still a small cap company with lots of risks.”

Your opinion matters. Please share your thoughts in our survey so that Newsweed can better serve you.

Are you a budding poet? Enter our poetry contest for bragging rights and an opportunity to win some cash!